Difference between day trade and buy and hold

Choosing Between Day Trading and Buy and Hold Strategies

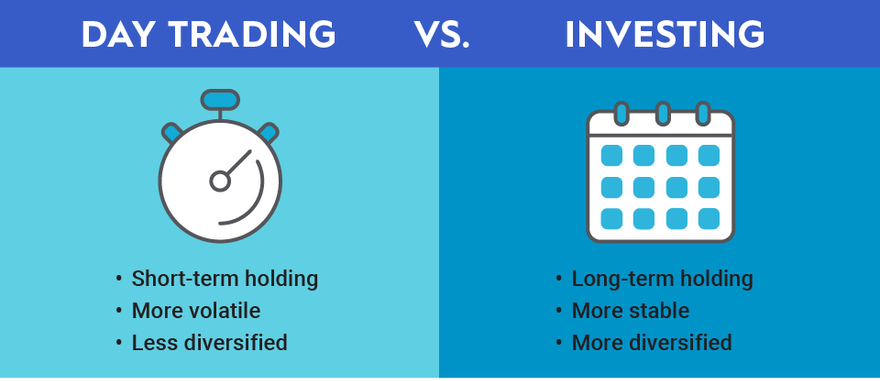

Investors frequently encounter a critical decision point regarding their trading strategy, primarily revolving around day trading and buy and hold approaches. The implications of this choice can drastically affect both their short-term financial gains and their overall wealth accumulation over time. With each strategy appealing to different risk appetites and investment objectives, a comprehensive understanding of these methodologies is essential.

Defining Day Trading

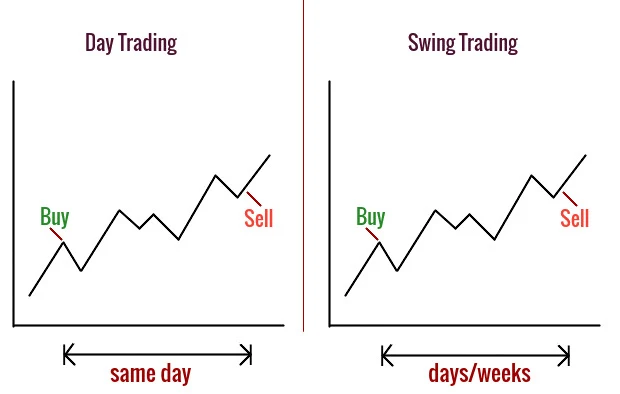

Day trading entails executing a series of trades within the confines of a single day, with the intention of capitalizing on minor fluctuations in security prices. This trading style requires keen market analysis and decisive execution, often leaning on technical analysis. Day traders typically utilize real-time data, charts, and news feeds to inform their trades. For example, a day trader may spot a significant uptick in a stock’s volume due to an earnings announcement and quickly buy to profit from the resultant price increase, subsequently selling the shares before the end of the trading day.

Understanding Buy and Hold

On the other hand, the buy and hold strategy involves acquiring securities and maintaining them over an extended period, often years, irrespective of market volatility. This approach is rooted in the belief that, over time, quality investments will yield significant returns despite short-term fluctuations. Historical data supports this strategy; for instance, the S&P 500 has demonstrated an average annual return of approximately 10% over the long term. An investor adopting this strategy might purchase blue-chip stocks and hold onto them through various market cycles, benefitting from compounding growth and dividends.

Analyzing Advantages and Disadvantages

- Day Trading Advantages: One of the primary benefits includes the potential for quick profits, as day traders can make multiple trades within a day, maximizing their opportunities. Additionally, day trading is adaptable; traders can respond swiftly to market news and changes, allowing for flexibility. However, this rapid trading also comes with inherent risks, including significant financial loss, given the dynamic nature of price movements.

- Buy and Hold Advantages: In contrast, buy and hold strategies typically boast lower transaction costs, as fewer trades are executed, leading to reduced fees. Furthermore, this approach requires less time and active involvement, allowing investors the freedom to focus on other endeavors while their investments mature. Notably, by minimizing emotional responses to market volatility, long-term investors can avoid detrimental decision-making.

Assessing Your Investment Goals

Ultimately, selecting between day trading and buy and hold should align with an individual’s unique financial situation, risk tolerance, and investment goals. Investors must consider factors such as their available time for monitoring trades, their psychological comfort with volatility, and their financial objectives, whether they lean towards short-term gains or long-term wealth accumulation. Being well-informed about the fundamental differences between these strategies enhances an investor’s ability to navigate the constantly evolving landscape of financial markets.

SEE ALSO: Click here to read another article

Key Differences in Trading Strategies

The distinction between day trading and buy and hold strategies lies primarily in their operational fundamentals, time commitment, and overall investment philosophies. Understanding these differences is crucial for investors aiming to tailor their financial endeavors according to their personal goals and risk profiles.

Time Commitment and Frequency of Trades

Day trading necessitates a considerable time investment, as traders actively monitor market movements throughout the trading day. Since positions are established and exited within the same day, day traders may make dozens, if not hundreds, of trades based on short-term price movements. This approach demands not only extensive market knowledge but also a strong ability to react promptly to real-time information. An example of this would be a day trader who employs strategies such as scalping, where minute price changes are exploited for rapid gains.

In contrast, the buy and hold strategy requires minimal ongoing time commitment once investments are made. Investors adopt this approach with the intention of holding onto securities for many years, often ignoring daily price fluctuations. This long-term perspective allows investors to ride out market volatility and focus on the fundamental performance of their investments, rather than getting caught up in the noise of the market. For instance, an investor might allocate funds to an index fund, with the expectation that its overall growth trajectory will yield favorable returns over a decade or more.

Risk Tolerance and Market Exposure

The level of risk associated with day trading is generally higher than that of buy and hold strategies. Day traders frequently utilize leverage to amplify their potential profits, which inherently increases their exposure to financial risks. A single unfavorable market movement can lead to substantial monetary losses within hours. Therefore, day trading is often suited for those with a higher risk tolerance and an ability to sustain potential losses.

Conversely, the buy and hold approach aligns with a more conservative risk profile, appealing to individuals who prefer a steadier and less volatile investment experience. By investing in well-established companies or diversified funds, buy-and-hold investors can mitigate risks associated with individual stocks. Historical data reinforces this concept; over the long term, the stock market has shown a consistent upward trend, making it more likely that patient investors will see positive growth.

Transaction Costs

- Day Trading Costs: Frequent trading results in elevated transaction costs, including commissions and fees that can significantly eat into profits. Additionally, the higher volume of trades can trigger tax implications, as gains are commonly taxed as short-term capital gains.

- Buy and Hold Costs: On the other hand, fewer transactions mean lower overall costs. Investors who adopt a buy-and-hold strategy incur minimal fees, benefiting from compounding returns without the burden of incessant trading expenses.

This understanding of the contrasting characteristics of day trading and buy and hold strategies equips investors with the necessary insights to make informed decisions regarding their investment journeys. By evaluating one’s own risk tolerance, time availability, and market understanding, investors can select an approach best suited to achieving their financial aspirations.

CHECK OUT: Click here to explore more

Psychological Factors and Market Analysis

The psychological components and analytical approaches associated with day trading and buy and hold strategies further differentiate these two investment styles. Understanding these facets helps investors grasp not only the mechanics of trading but also the mindset required for successful execution.

Emotional Resilience and Decision Making

Day trading can be an emotionally taxing endeavor as traders frequently contend with the rapid fluctuations of the market. The pressure to make instantaneous decisions in response to real-time developments can lead to significant stress and emotional fatigue. A successful day trader must cultivate emotional resilience and discipline to manage impulses and avoid irrational decision-making. For instance, during a volatile trading session, a day trader might feel tempted to react impulsively to minor price changes, which could lead to unnecessary losses.

Conversely, the buy and hold strategy often entails a less emotionally charged investment approach. Investors who adopt this method typically focus on long-term objectives without being swayed by daily market volatility. This long-term perspective allows buy-and-hold investors to maintain composure during downturns, as they generally believe in the underlying strength and future potential of their investments. For example, an investor adhering to a buy and hold philosophy may choose to ignore temporary market dips in favor of taking advantage of the enduring growth of blue-chip stocks.

Market Analysis Techniques

Both day traders and buy-and-hold investors employ differing market analysis techniques, which reflect their respective strategies. Day traders often rely on technical analysis, utilizing charts, patterns, and statistical indicators to predict short-term price movements. Common tools include moving averages, relative strength indicators, and candlestick patterns. This analytical approach demands not only a keen understanding of charting techniques but also the ability to respond swiftly to findings in the context of rapidly shifting market conditions.

On the other hand, buy and hold investors predominantly engage in fundamental analysis, focusing on the intrinsic value of investments. This might involve examining earnings reports, revenue growth, competitive positioning, and overall market trends. By comprehensively assessing a company’s fundamentals, these investors are better equipped to make informed decisions that align with long-term objectives. For example, an investor considering shares of a technology company might evaluate its research and development capabilities, market share, and potential for future growth to determine whether the stock is suitable for a long-term portfolio.

Investment Goals and Time Horizons

The ultimate goals associated with day trading and buy-and-hold strategies further exemplify their differences. Day traders often seek immediate profits, engaging in short-term strategies to capitalize on market inefficiencies. The allure of quick returns can overshadow the inherent risks involved, potentially leading to significant financial losses if trades do not pan out as expected.

In contrast, buy-and-hold investors aim for capital appreciation and income generation through dividends, benefiting from the compounding of returns over time. They often adopt a buy and hold strategy with the understanding that markets may be volatile in the short term, but historically exhibit upward trajectories over the long term. This patience allows them to harness the magic of compounding, which can result in substantial wealth accumulation.

Equipped with this understanding of the psychological factors and analytical techniques, investors can more effectively navigate their choices between day trading and buy-and-hold strategies, allowing them to align their investment behaviors with their financial objectives and personal dispositions.

CHECK OUT: Click here to explore more

Conclusion

In summary, the distinction between day trading and buy-and-hold strategies is rooted in varied investment goals, time horizons, and psychological requirements. Day trading caters to those seeking immediate profits through short-term market movements, demanding a high level of emotional resilience and rapid decision-making skills. This approach requires traders to monitor the markets closely, typically executing multiple trades within a single day to capitalize on small price fluctuations. For instance, a day trader might leverage tools such as technical analysis, chart patterns, and algorithms to identify potential entry and exit points. However, the fast-paced environment can create notable stress for traders, often necessitating rigorous discipline to navigate the inherent risks associated with frequent market transactions. The possibility of significant financial loss due to miscalculated trades can lead to heightened anxiety and emotional strain. Thus, successful day traders often employ strict risk management strategies, such as setting stop-loss orders and defining clear trading plans.

Conversely, buy-and-hold investors take a long-term perspective, focusing on the intrinsic value of their investments. This approach typically leads to a more stable emotional state, as investors are not heavily influenced by daily fluctuations but are instead anchored by their financial objectives and the principle of compounding growth. For example, an investor may purchase shares in a well-established company with strong fundamentals, such as Apple or Microsoft, and hold these shares for several years, allowing their value to appreciate and dividends to reinvest. By adopting a comprehensive analysis of a company’s fundamentals—such as earnings reports, market trends, and economic conditions—buy-and-hold investors aim to capture value over time and withstand temporary market volatility.

Ultimately, the choice between day trading and buy-and-hold investing hinges on an individual’s risk tolerance, investment horizon, and emotional disposition. Day traders often require a high tolerance for risk and the ability to manage stress effectively, while buy-and-hold investors may prefer a more conservative and methodical approach to wealth accumulation. By carefully weighing these factors and aligning them with personal financial goals, investors can make informed decisions that not only cater to their trading style preferences but also enhance their overall investment outcomes. Understanding these differences allows individuals to choose a strategy that best fits their financial situation, goals, and personal disposition, leading to a more fulfilling investment experience in the dynamic landscape of financial markets.

INVESTOPEDIA (2023). The 4 Types of Active Traders. 2011. Available at: https://www.investopedia.com/articles/active-trading/11/four-types-of-active-traders.asp

ANGELONE (2025). Stock Trading vs Buy and Hold: What’s the Better Strategy? Available at: https://www.angelone.in/knowledge-center/share-market/stock-trading-vs-buy-and-hold

MONEYWISE (2023). Buy and hold vs active trading: which strategy makes the most money? Available at: https://moneywise.com/investing/buy-hold-vs-active-trading

Related posts:

Tips for renting out your property safely and profitably

Analyzing Export-Driven Growth Strategy: Case Studies of Key Sectors

Strategies to Reduce Taxes During Retirement

What to Consider When Investing in Vacation Rental Properties

The importance of investing in financial education

How much to save per month to retire comfortably

Linda Carter is a writer and financial expert specializing in personal finance and financial planning. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on the our platform. Her goal is to empower readers with practical advice and strategies for financial success.